Unlocking Growth Prospective: Bagley Risk Management Approaches

Unlocking Growth Prospective: Bagley Risk Management Approaches

Blog Article

Safeguard Your Animals With Animals Danger Protection (Lrp) Insurance Policy

Animals manufacturers face a myriad of challenges, from market volatility to unpredictable weather. In such a dynamic atmosphere, guarding your livestock ends up being extremely important. Animals Threat Defense (LRP) insurance provides a calculated device for manufacturers to safeguard their financial investment and reduce possible economic dangers. By recognizing the ins and outs of LRP insurance policy, producers can make educated decisions that secure their livelihoods.

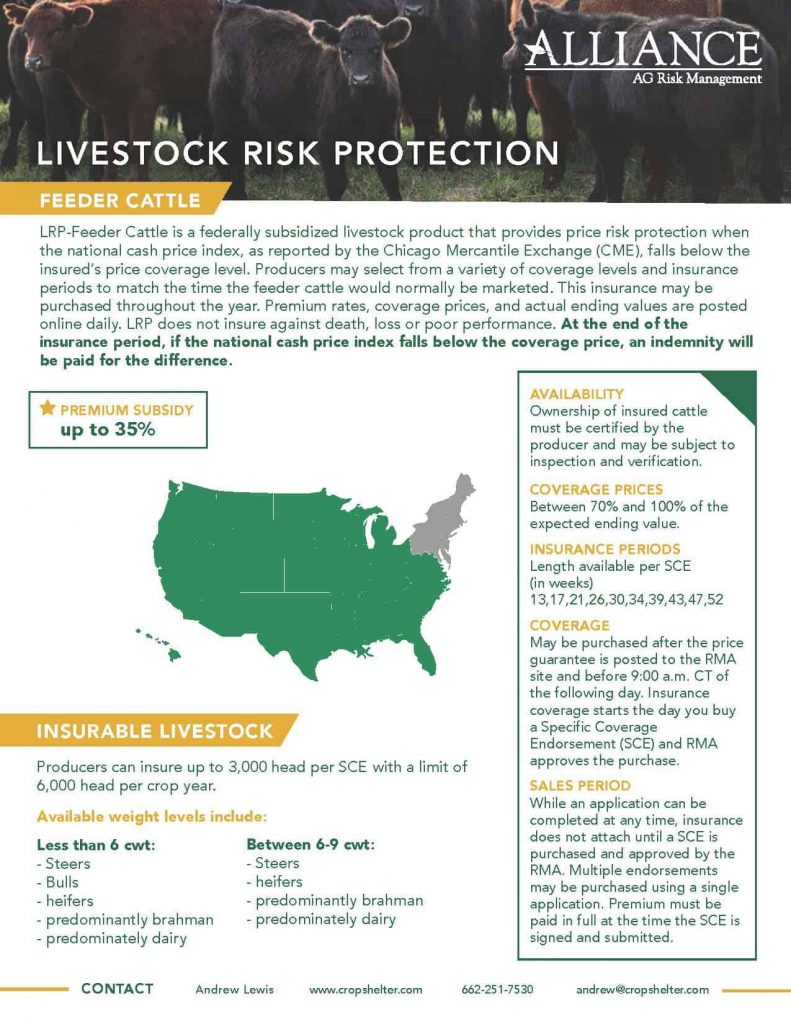

Understanding Animals Risk Protection (LRP) Insurance Policy

Livestock Risk Defense (LRP) Insurance coverage offers necessary insurance coverage for livestock manufacturers against prospective financial losses due to market value variations. This sort of insurance coverage allows producers to alleviate the risk linked with unpredictable market problems, ensuring a level of economic protection for their operations. By making use of LRP Insurance coverage, manufacturers can secure a minimum price for their livestock, safeguarding against a decrease in market value that might adversely affect their income.

LRP Insurance operates by using coverage for the difference in between the insured price and the actual market price at the end of the coverage duration. Producers can pick coverage levels and insurance coverage durations that line up with their particular requirements and take the chance of tolerance. This flexibility allows producers to tailor their insurance policy to ideal secure their financial rate of interests, offering satisfaction in a naturally unstable market.

Recognizing the ins and outs of LRP Insurance policy is vital for animals producers seeking to safeguard their operations versus market unpredictabilities. By leveraging this insurance device effectively, manufacturers can browse market changes with confidence, making sure the long-term feasibility of their livestock businesses.

Benefits of LRP Insurance Coverage for Animals Producers

Enhancing economic safety and security and stability, Animals Threat Defense (LRP) Insurance coverage provides important safeguards versus market value changes for manufacturers in the animals market. Among the essential advantages of LRP Insurance coverage is that it supplies manufacturers with a tool to handle the threat connected with unpredictable market value. By allowing manufacturers to establish a guaranteed rate flooring for their animals, LRP Insurance helps shield versus prospective losses if market prices drop listed below a certain level.

In Addition, LRP Insurance policy enables producers to make more educated decisions concerning their operations. With the assurance of a minimum price for their livestock, manufacturers can prepare in advance with higher self-confidence, recognizing that they have a safety web in position. This can bring about increased stability in revenue and reduced economic stress and anxiety during times of market volatility.

How LRP Insurance Mitigates Financial Dangers

By offering producers with a reliable safeguard versus market value fluctuations, Livestock Danger Security (LRP) Insurance properly safeguards their economic security and reduces prospective dangers. One key means LRP insurance aids minimize financial threats is by using defense against unanticipated decreases in animals rates. Manufacturers can acquire LRP policies for particular weight series of livestock, allowing them to hedge versus market slumps that might or else cause substantial economic losses.

Additionally, LRP insurance coverage gives manufacturers with assurance, knowing that they have a fixed level of price defense. This certainty permits producers to make informed decisions concerning their procedures without being unduly affected by unforeseeable market variations. Additionally, by decreasing the economic uncertainty related to cost volatility, LRP insurance allows manufacturers to much better strategy for the future, assign resources effectively, and eventually improve their general economic strength.

Actions to Safeguard LRP Insurance Coverage Coverage

Protecting LRP insurance policy coverage involves a series of straightforward actions that can offer manufacturers with useful security versus market unpredictabilities. The initial action in acquiring LRP insurance is to contact a certified crop insurance agent. These agents are well-informed concerning the program and can lead producers through the application process. Producers will require to offer fundamental information about their animals procedure, such as the sort of livestock being guaranteed, the number of head, and the coverage duration wanted.

When Click Here the application is sent, producers will require to pay a premium based on the coverage degree and variety of head guaranteed. It is necessary to evaluate and comprehend the policy completely before making any kind of payments to ensure it fulfills the details demands of the operation. Bagley Risk Management. After the costs is paid, producers will certainly obtain a certification of insurance policy, recording their protection

Throughout the insurance coverage duration, producers should keep comprehensive documents of their livestock supply and market prices. In case of a cost decrease, manufacturers can sue with their insurance policy representative to receive payment for the distinction in between the insured rate and the marketplace price. By complying with these actions, producers can guard their animals operation versus monetary losses caused by market fluctuations.

Maximizing Worth From LRP Insurance

To extract the complete advantage from Animals Threat Security Insurance, manufacturers should purposefully utilize the protection alternatives offered to them. Making the most of the worth from LRP insurance coverage includes a complete understanding of the policy features and making notified decisions.

Furthermore, manufacturers can improve the worth of LRP insurance policy by leveraging complementary threat administration devices such as futures and options contracts. By diversifying risk administration approaches, manufacturers can reduce potential losses a lot more properly. It is vital to stay educated concerning market patterns, federal government programs, and market developments that can affect livestock rates and run the risk of management strategies.

Inevitably, taking full advantage of the worth from LRP insurance policy needs positive preparation, recurring surveillance, and flexibility to transforming conditions. By taking a tactical approach to risk administration, producers can secure their animals operations and boost their overall monetary stability.

Conclusion

In verdict, Livestock Danger Security (LRP) Insurance policy supplies useful benefits to livestock producers by alleviating financial threats connected with variations in market prices. Bagley Risk Management. By securing LRP insurance coverage, manufacturers can protect their animals investments and potentially raise their earnings. Comprehending the actions and benefits to make best use of worth from LRP insurance policy is necessary for animals manufacturers to efficiently handle risks her explanation and protect their companies

Animals Danger Security (LRP) Insurance offers essential coverage for animals producers versus possible financial losses due to market rate changes.Enhancing monetary protection and stability, Livestock Danger Defense (LRP) Insurance uses valuable safeguards against market cost changes for producers in the animals sector.By offering producers with a trusted safety and security web against market cost fluctuations, Animals Risk Security (LRP) Insurance policy effectively safeguards their financial security and decreases potential risks. The initial step in getting LRP insurance is to speak to an accredited plant insurance coverage agent.In conclusion, Animals Danger Defense (LRP) basics Insurance coverage supplies useful advantages to livestock producers by reducing economic threats associated with fluctuations in market prices.

Report this page